Ohio Homestead Exemption 2024

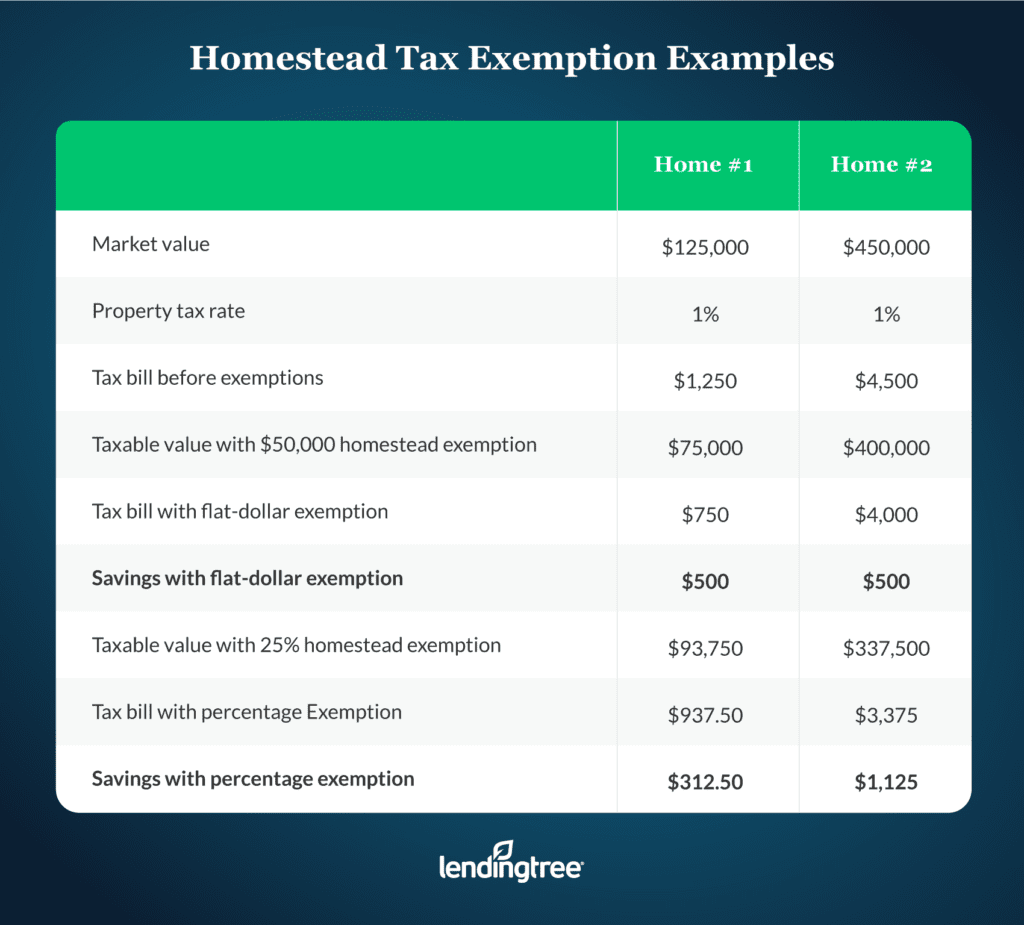

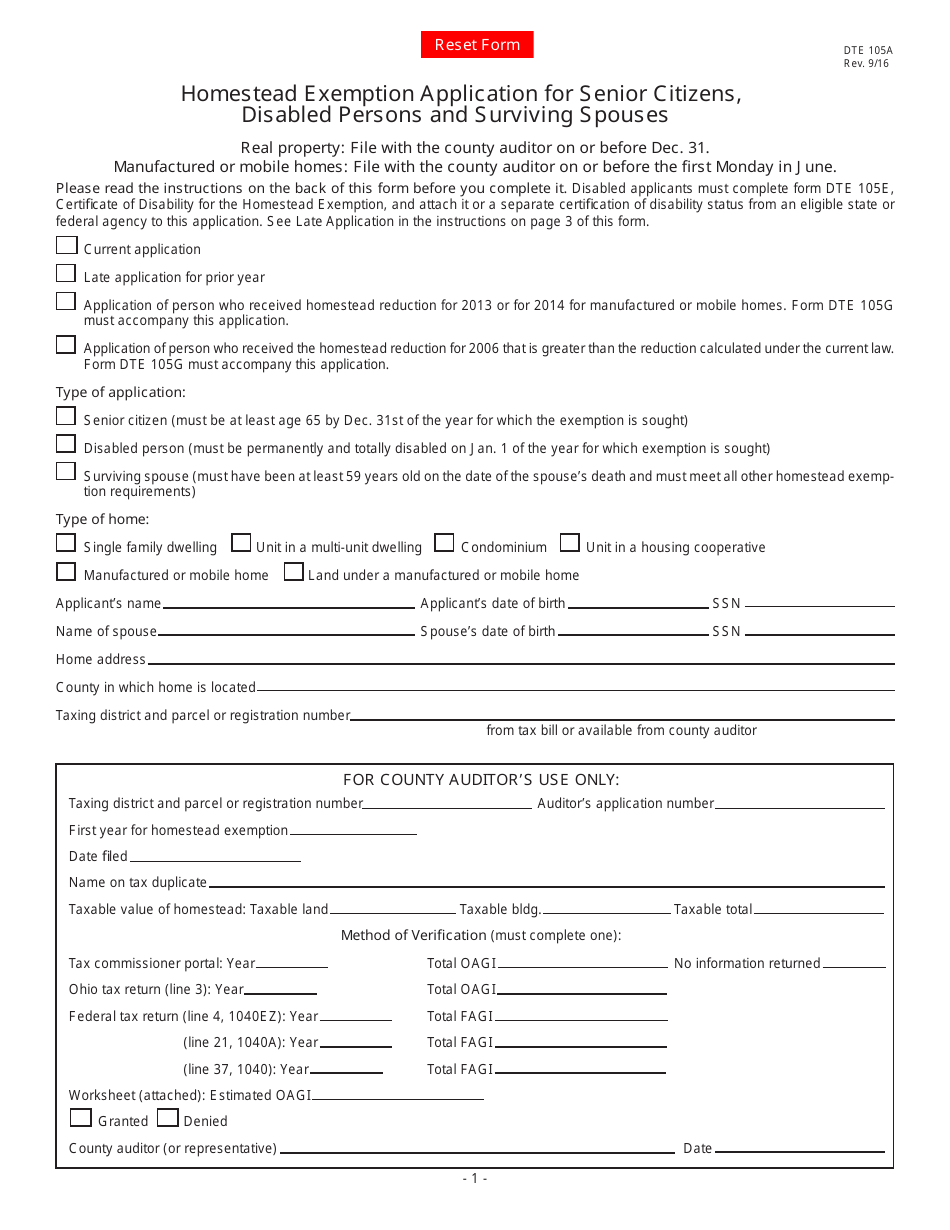

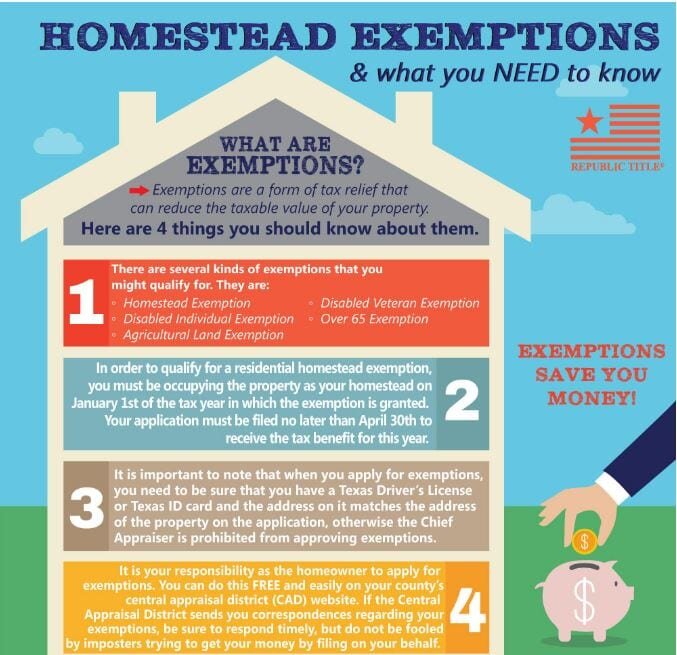

Ohio Homestead Exemption 2024. The homestead exemption allows qualifying senior citizens, disabled persons, and surviving spouses to reduce their property tax burden by shielding up to $26,200 of the value of their. The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden by shielding some of the auditor’s appraised.

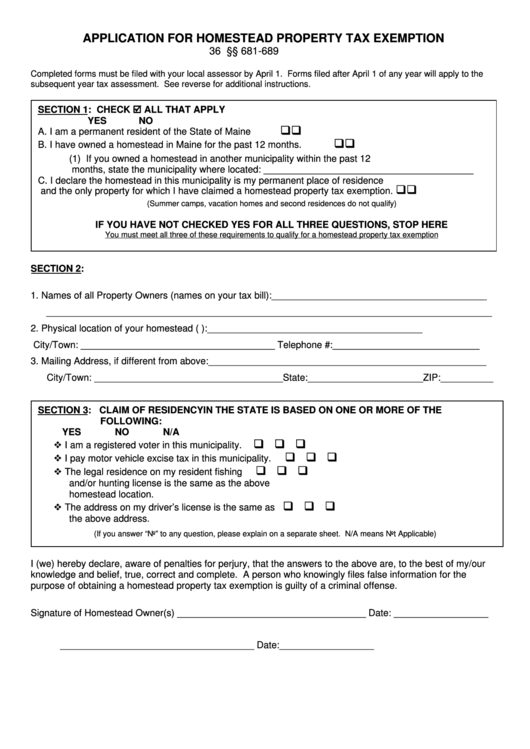

If qualifying for the first time in calendar year 2024, you must have an ohio adjusted gross income (oagi) (line 3 of the 2023 ohio income tax return) of $38,600 or less. All homeowners who qualify for the homestead exemption will receive a flat $26,200 property tax exemption on the market value of their home.

Ohio Homestead Exemption 2024 Images References :

Source: alisunqannadiane.pages.dev

Source: alisunqannadiane.pages.dev

Ohio Homestead Exemption 2024 For Seniors Hetty Laraine, House democrats have introduced bipartisan legislation to help ohio’s lower their property taxes:

Source: gwynycecilia.pages.dev

Source: gwynycecilia.pages.dev

Ohio Homestead Exemption 2024 Form Etti Olivie, Ohio’s homestead exemption allows qualifying senior citizens, and permanently and totally disabled ohioans, to reduce their property taxes by exempting $25,000 of the home’s market.

Source: dosiqkatharyn.pages.dev

Source: dosiqkatharyn.pages.dev

Homestead Exemption Ohio 2024 Brit Marney, House bill 187 increases the income eligibility amount from $36,100 to $75,000.

Source: exyxhxdqy.blob.core.windows.net

Source: exyxhxdqy.blob.core.windows.net

What Is Homestead Exemption Ohio at Megan Fournier blog, Homestead reduces property taxes to qualified senior or permanently disabled citizens.

Source: alisunqannadiane.pages.dev

Source: alisunqannadiane.pages.dev

Ohio Homestead Exemption 2024 For Seniors Hetty Laraine, The exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt up to $25,000 of the market value of their homes from all local.

Source: audraycissiee.pages.dev

Source: audraycissiee.pages.dev

Ohio Homestead Exemption 2024 Limit Belva Cathryn, The homestead exemption is a valuable tax reduction providing summit county homeowners an average savings of $535 per year.

Source: yourrealtorforlifervictoriapeterson.com

Source: yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson, The homestead exemption program allows qualifying marion county residents to shield some of the market value of their principal place of residence from taxation.

Source: denysroxanna.pages.dev

Source: denysroxanna.pages.dev

Ohio Homestead Exemption 2024 Brooke Violante, The homestead exemption is a valuable tax reduction providing summit county homeowners an average savings of $535 per year.

Source: alisunqannadiane.pages.dev

Source: alisunqannadiane.pages.dev

Ohio Homestead Exemption 2024 For Seniors Hetty Laraine, The qualifying oagi is adjusted annually by the ohio department of taxation.

Source: gwynycecilia.pages.dev

Source: gwynycecilia.pages.dev

Ohio Homestead Exemption 2024 Form Etti Olivie, Qualifying homeowners must have an income below $36,100 and either be at least 65 years old, or totally and permanently disabled, or the surviving spouse of someone.

Posted in 2024